With the precision of a Swiss watch, no sooner has 5G just started to be rolled out around 2020 than the first conversations began on 6G. That has been the average ten-year repeat pattern over the past forty years.

As we saw happen in the early stages of 5G, a lot of ideas were floated of what 6G would be – the merging of the real and virtual worlds, integration of sensing and communications, data speeds at Gb/s using Terahertz spectrum, teleportation to name but a few. Then on top of that 6G would address all the societal challenges – such as climate change and pandemic control. In spite of this richness of possibilities 6G is the most uncertain of all the sequence of mobile “next generation” technologies.

Listen to that proverbial Swiss watch and the sound of a grinding of the gear wheels inside is audible. At the heart of these step change infrastructure innovations is an infrastructure innovation business model now under extreme stress in many countries.

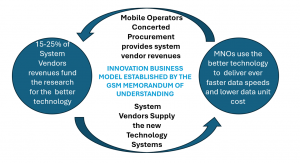

The mobile infrastructure innovation business model foundation was laid in 1987 with the GSM Memorandum of understanding. It orchestrated and synchronized a massive order book of next generation radio access networks. It created the certainty for the vendors of a market. See Figure 1

Figure 1 – The massively successful mobile infrastructure innovation business model

This massive order book in waiting galvanized vendors to invest heavily in R&D. Their investments were then paid back through the MNO procurement orders for new non backwards compatible 2G Radio Access Networks. This replenished the coffers of the vendors – who could press ahead with high research investments in the next generation of mobile innovation.

The MNOs benefited hugely by sharing a common goal and synchronizing their procurements of higher performing networks based upon global standards they had a hand in shaping. It secured for them:

-

-

-

-

- Better performing networks

- Large economies of scale (reducing costs)

- Mutualizing risks

-

-

-

This infrastructure innovation business model has driven 3G, 4G and 5G – giving users a 10,000-fold increase in mobile data speeds at affordable prices to both MNOs and consumers (for their mobiles). It has also led to anyone getting of a plane in almost any country, switching on their smartphone – and it just works.

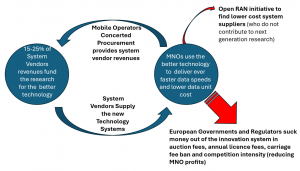

But, at least in Europe, just prior to 3G, a new breed of independent regulator was introduced. Their duties did not include improving the mobile infrastructures they regulated. Their laser focus was on the lowest possible prices for consumers their network usage. A financially extractive regulatory framework was thus wrapped around the MNOs in those affected markets. Its unintended consequence has been to bleed much of the investment capacity out of the infrastructure innovation business model. This is illustrated in Figure 2.

Figure 2 – A financially extractive regulatory system has been strapped around European and other Mobile Network Operators

The vendor community business models still depends upon the continuation of the formula whereby 6G would be a new non-backwards compatible Radio Access Network rolled out in a new spectrum band. Without this order book-in-waiting from all the MNOs buying the new 6G Radio Access Networks – their innovation business model collapses.

But the Mobile Network Operators baulk at the idea that 6G would require them to step up levels of investment to procure new non backward compatible Radio Access Networks. They know that investments at this level would never deliver a return. Their shareholders would also take a dim view as, in Europe, MNO share prices have flat lined from a lack of growth and paucity of profits.

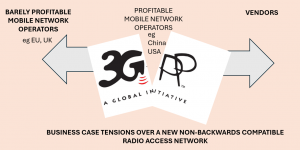

But not all Mobile Network Operators have suffered the same intensity of financially extractive regulation as those based in Europe, for example, China and the USA. This has led to a three way tension over the future ambition for 6G, as shown in figure 3.

Figure 3 – Less Profitable Mobile Network Operators versus their Suppliers with their own financial challenges

The highly profitable mobile network operators are open minded about a 6G non-backwards compatible Radio Access Network. Their interest in a revolutionary 6G will depend upon what the vendors’ new technologies offer in terms of benefits. Let’s call this “the revolutionary” version of 6G.

The only sort of revolutionary 6G that the barely profitable mobile network operators would even consider is one that either generated new revenue streams or offered deep cuts in the running cost of their 5G networks.

This difference in economic circumstances of MNOs is not the only force in play in the mobile research community. Geopolitical tensions, particularly between the USA and China, are threatening to tear apart universal global cooperation in all parts of the hitherto globalized world. This geopolitical tension has already intruded into the global mobile supply chain in 5G. It could be even more divisive with 6G. See Figure 4

Figure 4 – The US and China are now the two global technology superpowers in a race for supremacy

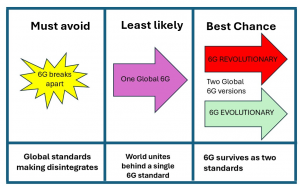

This leaves 6G poised between one of three outcomes as shown in figure 5. The worst outcome would be for the hitherto highly cohesive global mobile industry to break-up into many rival 6G blocks (China, USA, EU, India and S Korea to name but five). Nobody owns the 6G label, so each of the different rival industrial factions could all claim their technology is “the true 6G”. But fragmented standards would diminish scale economies and wreck global inter-operability.

Figure 5 – 6G outcomes and “the one best chance”

This disintegration of global 6G prospects is not inevitable. The global relationships between MNOs and their vendors run deep. Trust built over many years of fruitful cooperation exists between MNOs and they have all benefited hugely from moving together in lockstep to take advantage of further technology advances.

The prospect for the world uniting around a single 6G technology standard does not look tenable. The two camps not only have different capacities to invest but also start from very different 5G situations. China’s 5G networks are now vastly superior than the UK’s 5G networks for example. This disparity of economic circumstances leads to an inevitability of a two speed mobile infrastructure innovation world.

A 6G solution has to embrace and bridge these two very different financial circumstances.

This leads logically onto two 6G standards – one evolutionary and one revolutionary . The evolutionary 6G would be shared by all…sustaining that common global thread. The revolutionary one (involving a non-backwards compatible new Radio Access Network) would be driven forward by the premier division of mobile network operators. The aim of the revolutionary approach would be to reach new limits in performance, perhaps in higher mid-band spectrum.

What does an evolutionary 6G look like? There are many improvements that are needed to current mobile networks requiring innovations. So it is a package of improvements rather a singular focus on a revolutionary new Radio Access Network. The self interest of even the financially stretched MNOs (and one might say particularly the financially stretched MNOs) is to find common ground with other MNOs in a similar position around the world on what improvements could be the shared priority.

A useful 2025 snapshot of what at least three UK MNOs saw as their future needs can be viewed in the following White Paper https://www.surrey.ac.uk/sites/default/files/2025-06/UoS-6GIC-SAB-6G-White-Paper.pdf.

The orchestration and synchronization of procurement for this 6G “portfolio of evolutionary innovations” is a proven means of achieving the scale that dramatically drives down the costs for everyone. It also incentivizes the vendors to invest in the R&D for these innovations. In this way the GSM Memorandum of Understanding foundational innovation business case is as good today as it was in 1987 delivering:

-

-

-

-

-

- Better performing networks

- Large economies of scale (Lower prices)

- Mutualized risks

-

-

-

-

This could be the best of all worlds outcome as, if the revolutionary 6G version turns out to deliver real benefits, the MNOs who opted for the evolutionary approach still have the option to follow the global leaders and eventually invest in a proven revolutionary new radio access network.